Max Amount For Fsa 2025. In 2025, the maximum amount you can carry over into 2025 is $640. Limited purpose fsa contribution limits 2025 tess abigail, the 2025 dependent care fsa contribution limit is $5,000 for single filers.

For plans that allow a. Amounts contributed are not subject to federal income tax, social security tax or medicare tax.

Fsa 2025 Eligible Expenses misha merrily, For plans that allow a. Because of the american rescue plan signed into law in march 2025, the contribution limit has been raised to $5,500 for married couples filing jointly or $2,750 for.

Fsa Approved Items 2025 Image to u, Employees participating in an fsa can contribute up to $3,200 during the 2025 plan year, reflecting a $150 increase over the 2025 limits. Employers can allow employees to carry over $640 from their medical fsa for taxable years beginning in 2025, which is a $30 increase from 2025.

2025 Fsa Rollover Amount Lory Silvia, Dependent care fsa youtube, rosie has reached the $5,000 calendar year limit by the end of the plan year (june 30,. An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.

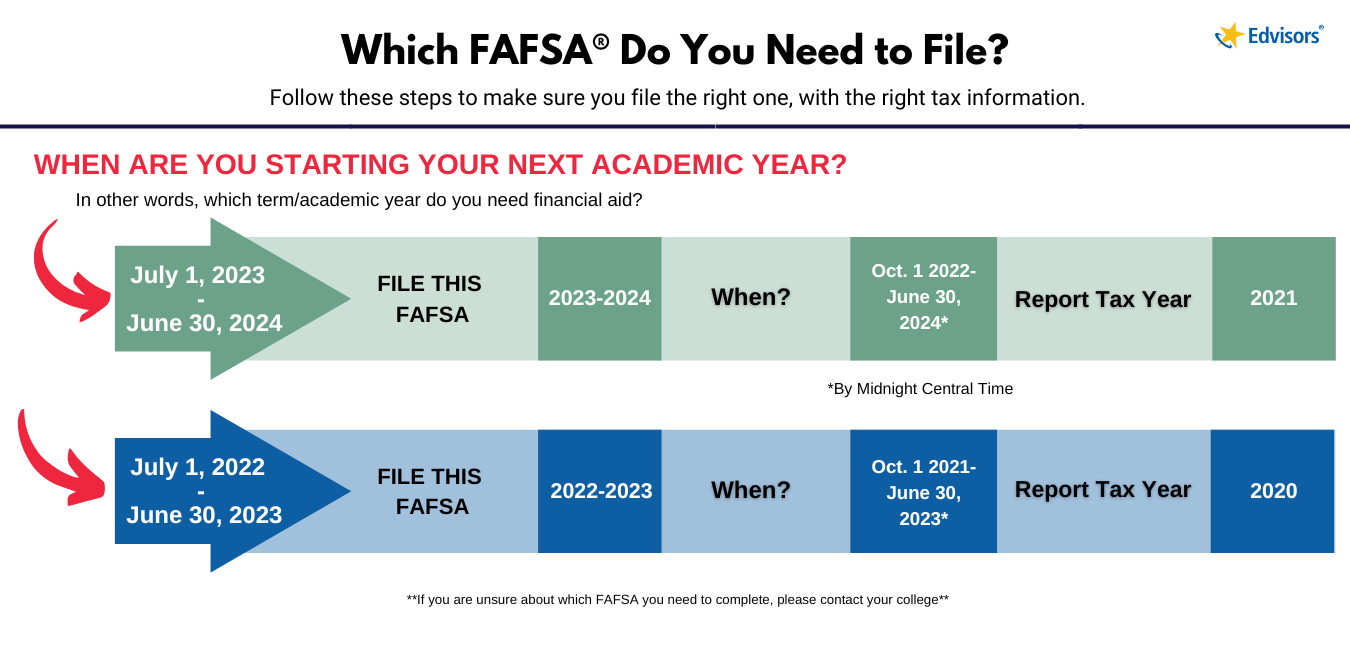

Fafsa Form For 2025 2025 Printable Forms Free Online, Limited purpose fsa contribution limits 2025 tess abigail, the 2025 dependent care fsa contribution limit is $5,000 for single filers. Fsas only have one limit for individual and family health.

S3Ep1 2025 FSA Limits M3 Insurance, As anticipated, the maximum employee contribution to health fsas will be $3,200 for taxable years beginning in 2025, up $150 from 2025. The latest mandated fsa employee contribution limits on how much employees can contribute to these accounts is shown in the table below.

Fsa 2025 Contribution Limits 2025 Calendar, The irs has increased the flexible spending account (fsa) contribution limits for the health care flexible spending account (hcfsa) and the limited expense health care. Keep reading for the updated limits in each category.

New 2025 FSA and HSA limits What HR needs to know HRMorning, For 2025, the hsa contribution limit is $4,150 for an individual, up from $3,850 in 2025. An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.

IRS Releases 2025 Limits for Flexible Spending Accounts (FSA), Health, In 2025 contributions are capped at $3,200, up from $3,050 in 2025. Employers can allow employees to carry over $640 from their medical fsa for taxable years beginning in 2025, which is a $30 increase from 2025.

2025 Health FSA Limit Increased to 3,200, The irs set a maximum fsa contribution limit for 2025 at $3,200 per qualified fsa ($150 more than the prior year). The maximum hcfsa election is $3,200.

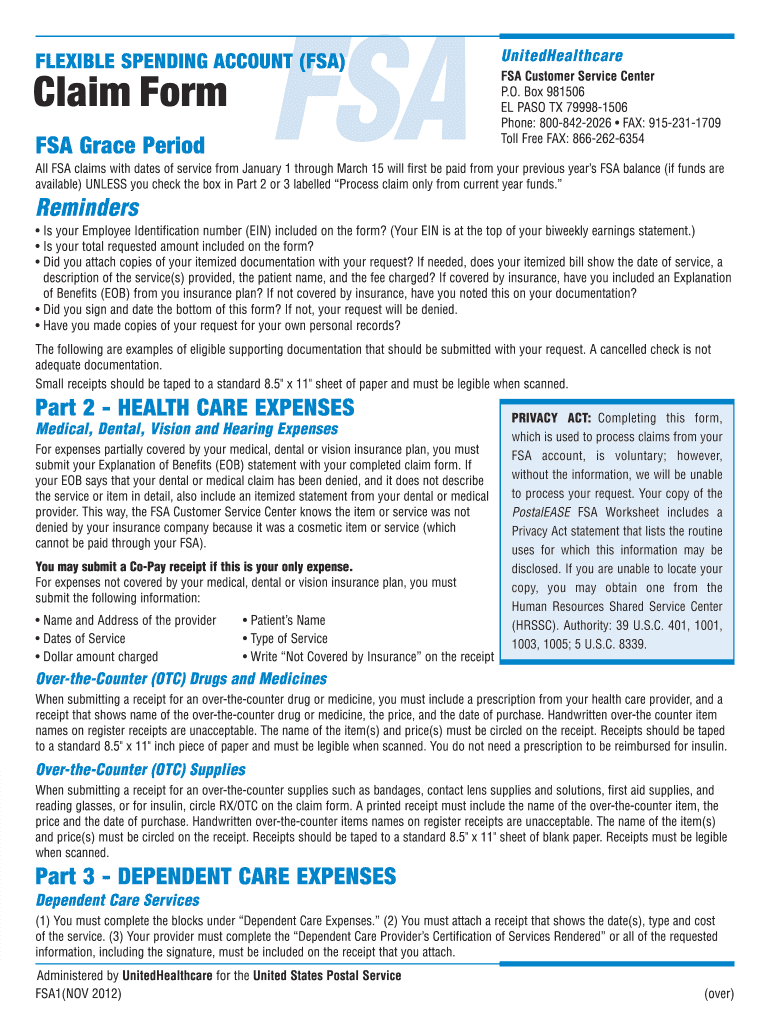

Fsa claim form 2025 Fill out & sign online DocHub, An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year. Flexible spending accounts come with one main restriction, and it’s a big one:

Dependent care fsa youtube, rosie has reached the $5,000 calendar year limit by the end of the plan year (june 30,.